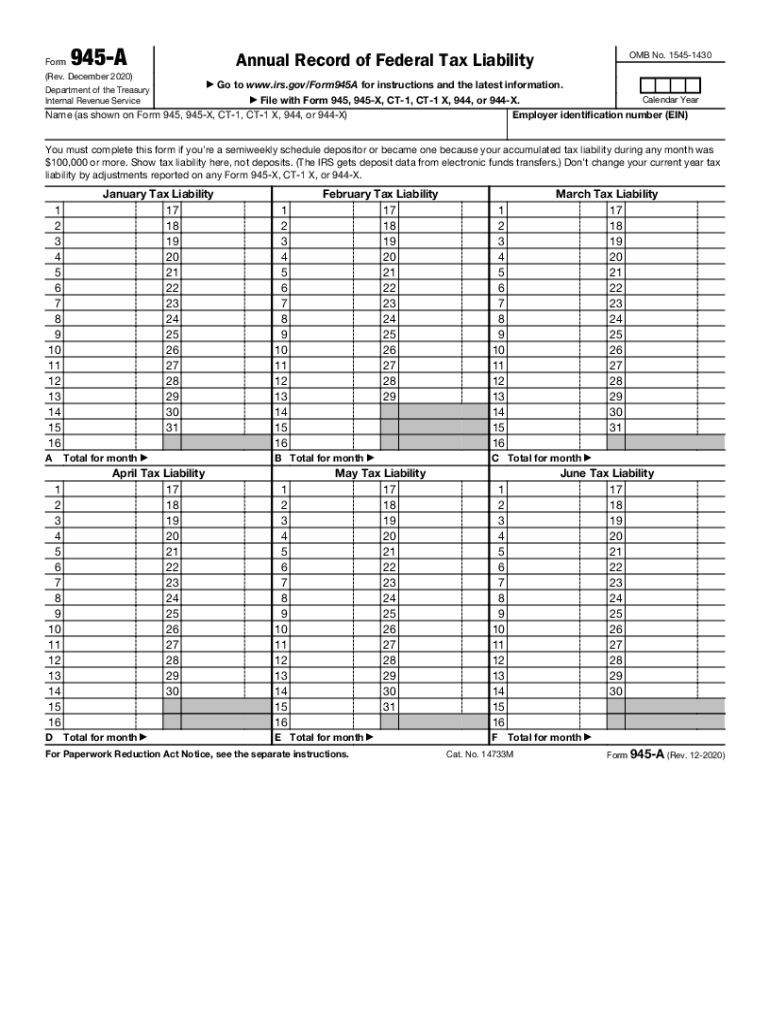

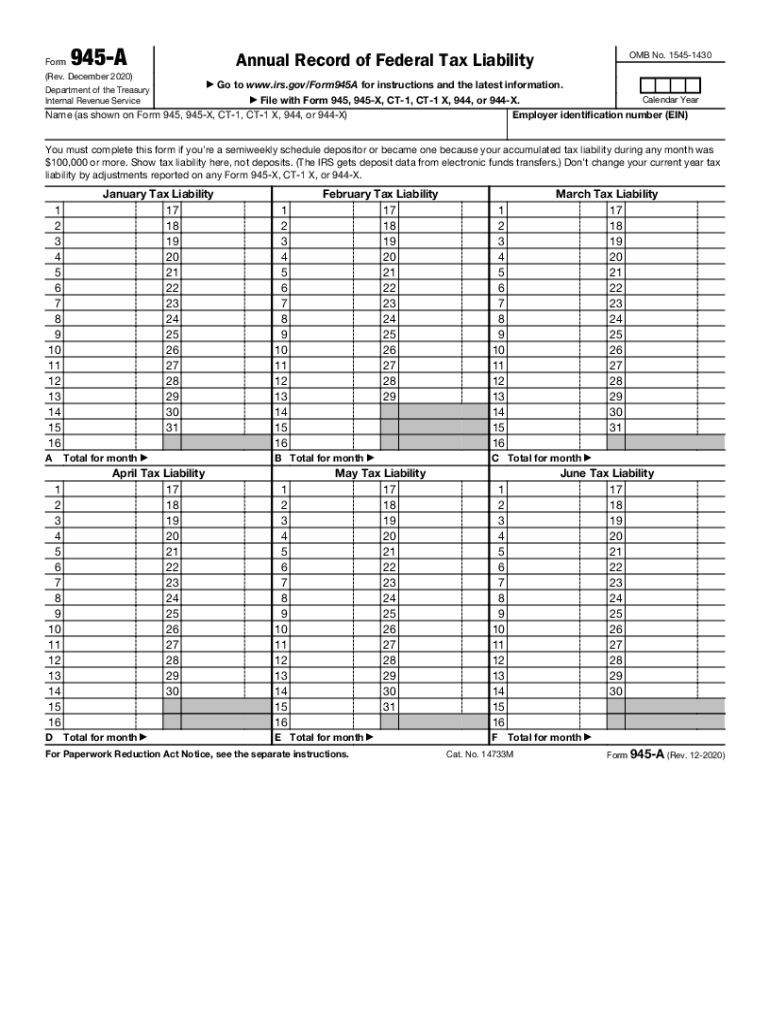

IRS 945-A 2020-2024 free printable template

Get, Create, Make and Sign

Editing 945 a fillable online

IRS 945-A Form Versions

How to fill out 945 a 2020-2024 form

How to fill out 945 a?

Who needs 945 a?

Video instructions and help with filling out and completing 945 a fillable

Instructions and Help about form 945 a

IRS Form 940 Script Hi everyone, I'm Priyanka Prakash, senior staff writer at Fund era. Today, I'll be showing you how to fill out Form 940: Employer’s Annual Federal Unemployment Tax Return, more commonly called the FTA tax return. You must file this form if you paid $1,500 or more in wages to employees during a calendar quarter of this year or the previous year, or if you employed anyone for at least 20 weeks of the year. This form is due on January 31. However, you get an additional 10 calendar days to file if you deposited all your FTA taxes on time throughout the year. Now, most employers have to pay FTA at the federal level and state unemployment tax. As you’ll soon see, the two are closely related. As a reminder, FTA tax is only paid by employers, so this is not a tax that you would deduct from your employees’ wages. Okay, let's get started with the form. The top of the form is pretty straightforward. You're just going to note down your business contact information, including the EIN, business name, and business address. I'll provide this information for a fictional business called ABC Bakery LLC. If...

Fill form 945 a : Try Risk Free

People Also Ask about 945 a fillable

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your 945 a 2020-2024 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.